PayPal Pay in 4 is a way for paying that lets users divide their buying into four equal parts, with no interest or charges, stretched over six weeks. This service gives customers the advantage of handling their money flexibly by making big purchases easy to manage through smaller and regular payments.

1. How Does PayPal Pay in 4 Work?

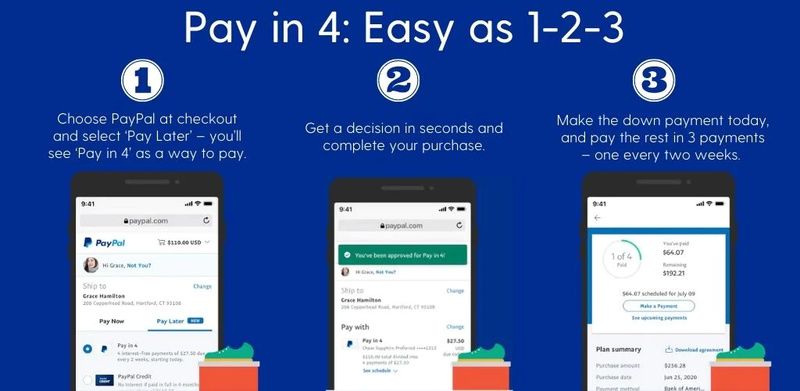

Customers have the option to use PayPal Pay in 4 when they make a purchase online or in-store at qualifying merchants. When this is selected, the total amount of the purchase gets split into four equal parts and it starts with an initial payment that needs to be made immediately upon making the purchase. The following three payments are automatically taken from your connected debit or credit card every two weeks.

PayPal Pay in 4 provides flexibility in managing payments. For every part, clients can select their desired way of payment like a debit card, credit card, or bank account that's linked with PayPal. This characteristic lets users personalize the timing and method of payment based on their financial circumstances and likes.

- Customizable Payment Methods: Users can select different payment methods for each installment, providing flexibility in managing finances.

- Automatic Payments: Payments are automatically deducted from the linked payment method every two weeks, reducing the risk of missed payments and late fees.

2. Benefits of Using PayPal Pay in 4

PayPal Pay in 4 has the main benefit of being convenient and flexible. It lets customers divide the price into four parts, which makes it easier for them to buy costly items. There are no interest or late fees tied to this payment method. This feature makes PayPal Pay in 4 an economical choice for people who pay attention to their budget.

A further advantage is the smooth connection with PayPal accounts. People can effortlessly handle their payments and follow up on how they spend money by utilizing the PayPal app or website. The feature of making purchases via only a few clicks enhances the ease of using PayPal Pay in 4.

- Budget-Friendly Solution: No interest charges or late fees make PayPal Pay in 4 an affordable option for budget-conscious consumers.

- Streamlined Payment Management: Integration with PayPal accounts allows for easy payment tracking and management through the PayPal app or website.

3. Eligibility and Requirements

To utilize PayPal Pay in 4, customers need to possess a good-standing PayPal account and associate it with an operational debit or credit card. All vendors do not provide an alternative for this kind of payment. Therefore, customers must search for PayPal Pay in 4 logos at checkouts to confirm their eligibility. There could be minimum purchase requirements established by each vendor.

Remember, the possibility to use PayPal Pay in 4 is not guaranteed for everyone. It depends on things like your credit history and account standing. So before you try to pay with it, make sure that your PayPal account satisfies all needed conditions.

- Varied Eligibility Criteria: Eligibility for PayPal Pay in 4 may depend on factors such as credit history and account status, so users should review requirements before attempting to use the service.

- Merchant Participation: Not all merchants offer PayPal Pay in 4, so customers should check for the option at checkout to determine availability.

4. How to Sign Up for PayPal Pay in 4?

To sign up for PayPal Pay in 4, you simply need to do it when checking out at shops that offer this service. If you have a PayPal account already, just choose the Pay in 4 option and go through the steps provided to finish your buy. For new users who don't have an existing account with us yet, they should create one first and connect their debit or credit card before utilizing our feature called PayPal Pay In 4.

Moreover, a fast credit investigation might be necessary for customers while they are checking out. This is to confirm if the customer is eligible for PayPal Pay in 4. The checking process usually happens within seconds and does not affect the person's credit score.

- Simple Sign-Up Process: New users can easily sign up for PayPal Pay in 4 during the checkout process while existing PayPal users can select the option and proceed with the purchase.

- Quick Credit Check: Customers may undergo a brief credit check during checkout to verify eligibility for PayPal Pay in 4, with no impact on their credit score.

5. Security and Protection

With PayPal Pay in 4, customers have the same safety and protection as they do with regular PayPal transactions. People who buy are covered by Purchase Protection from PayPal, which means that if they don't get their order or it doesn't match what was described by the seller, they will get a full refund. This extra layer of security makes sure that customers feel confident when using PayPal Pay in 4 for their purchases.

PayPal's Fraud Protection, like Purchase Protection, also applies to PayPal Pay in 4 transactions. It uses strong encryption technology and checks transactions constantly to stop any unauthorized use of accounts and protect customer details.

- Purchase Protection Coverage: PayPal Pay in 4 transactions are covered by PayPal's Purchase Protection policy, offering buyers a refund if the order is misrepresented or doesn't arrive.

- Fraud Protection Measures: Transactions made with PayPal Pay in 4 benefits from PayPal's advanced fraud protection, including encryption technology and real-time monitoring to safeguard against unauthorized use and protect customer data.

Conclusion

In conclusion, PayPal Pay in 4 provides a convenient and flexible payment solution for customers looking to manage their finances more effectively. With the ability to split purchases into four equal payments, with no interest or fees, PayPal Pay in 4 makes it easier for shoppers to afford the items they want. By understanding how PayPal Pay in 4 works, its benefits, and eligibility requirements, customers can make informed decisions about using this payment method for their future purchases.

How to Pay Your Property Tax Bill

All You Should Know About PayPal Pay in 4

Explaining the Mechanics: Insights into Working and Premium Determinants

How YouTube Makes Money Off Videos

A Comprehensive Guide for Capital Gains Tax Exclusion for Primary Residences

USDA Home Loans: Everything You Need to Know

Best Dental Insurance for Braces of 2023

Understanding FICA Tax: A Comprehensive Guide

Strategies for Managing Fixed-Income Securities

What Is Expected Value (EV)?

Different Ways Home Buyers' Agents Earn Their Money