Understanding the Federal Insurance Contributions Act (FICA) tax is crucial for both employees and employers in the United States. This essential tax funds vital social safety nets, including contributions to Social Security and Medicare. For employees, FICA tax is automatically deducted from each paycheck, while employers match this contribution, effectively doubling the funding. The tax comprises 6.2% for Social Security and 1.45% for Medicare, ensuring financial support for retirees, disabled individuals, and survivors of deceased workers.

Components of FICA Tax:

FICA tax is composed of two key components: Social Security and Medicare. These programs offer crucial benefits to eligible recipients, aiding them in times of financial need. In this section, we will explore the intricacies of each program and how they make up the total FICA tax contribution.

1. Social Security:

Social Security is a federal program designed to provide income support for retirees, disabled individuals, and survivors of deceased workers. It functions as a social insurance system, where workers contribute through payroll taxes during their employment years and later receive benefits upon retirement or disability. The retirement benefits an individual receives are based on their Average Indexed Monthly Earnings (AIME), which considers their highest 35 years of earnings, adjusted for inflation.

2. Medicare:

Medicare is a federal health insurance program offering coverage to individuals aged 65 and older, as well as those with specific disabilities or end-stage renal disease. Funded through payroll taxes, Medicare serves as a crucial safety net for millions of Americans who might otherwise struggle to afford healthcare in their later years. The program is divided into different parts covering various aspects of healthcare: hospital insurance (Part A), medical insurance (Part B), prescription drug coverage (Part D), and additional benefits such as dental, vision, and hearing (Part C).

Implications of FICA Tax:

Grasping the implications of FICA tax is essential for both employees and employers, as it affects their finances distinctively. For employees, the automatic deduction of FICA tax from their paychecks reduces their take-home pay but can be seen as an investment in future retirement benefits and healthcare coverage. For employers, FICA tax increases the overall cost of hiring and must be considered when setting employee salaries and benefits packages. Employers are also tasked with the precise calculation, withholding, and timely remittance of FICA taxes to the government.

How FICA Tax Is Calculated?

FICA tax is determined by an individual's earnings and the prevailing tax rates. The Social Security portion has a cap on taxable earnings, meaning only income up to a certain threshold is subject to the 6.2% tax. For 2023, this cap is set at $142,800 of annual income. Earnings above this limit are exempt from the Social Security portion of FICA tax.

Conversely, there is no wage base limit for Medicare taxes, so all wages are subject to the 1.45% tax rate. Additionally, high-income earners may incur an extra Medicare surtax of 0.9% on wages exceeding $200,000 for individuals or $250,000 for married couples filing jointly.

Employers are responsible for withholding the correct amount of FICA tax from their employees' paychecks and matching this contribution. Self-employed individuals must pay both the employer and employee portions of FICA tax through self-employment taxes.

Employer and Employee Contributions:

FICA tax is split between employers and employees. Employers are responsible for matching their employees' contributions to Social Security and Medicare, effectively doubling the total amount paid for each employee. For example, if an employee's wages are subject to a 6.2% Social Security tax, their employer must also pay another 6.2%, making the total contribution 12.4%. Similarly, for Medicare taxes, employers must match their employees' 1.45% contribution, resulting in a total of 2.9%.

Breakdown of Contributions:

- Social Security: Employees contribute 6.2%, matched by employers with an additional 6.2%, totaling a 12.4% contribution.

- Medicare: Employees pay 1.45%, matched by employers with another 1.45%, amounting to a total contribution of 2.9%.

- Additional Medicare Surtax: High-income earners may face an extra 0.9% Medicare surtax on wages exceeding $200,000 for individuals or $250,000 for married couples filing jointly.

Employer Obligations:

Employers are required to accurately calculate, withhold, and remit FICA taxes on behalf of their employees. Non-compliance can result in penalties and interest charges from the IRS. Additionally, employers must provide annual W-2 forms summarizing their employees' earnings and tax contributions for the year.

Employee Responsibilities:

Employees should verify that their employers are withholding the correct amount of FICA tax from their paychecks and report any discrepancies to the IRS. They should also keep track of their earnings, contributions, and eligibility for Social Security and Medicare benefits.

Exemptions and Special Cases:

While the majority of individuals are subject to FICA tax, there are some exemptions and special cases that should be noted. Non-resident aliens, certain religious groups, and students working for their school may be exempt from paying FICA taxes. Additionally, there are specific rules for government employees and members of the clergy.

Self-employed individuals also have different guidelines when it comes to FICA tax. They are responsible for paying both the employer and employee portions of FICA tax through self-employment taxes, but they may be able to deduct a portion of these taxes on their personal tax return.

The Impact of FICA Tax:

FICA tax plays a significant role in sustaining important federal programs like Social Security and Medicare. By understanding how this tax is calculated and the contributions made by employers and employees, individuals can gain a better understanding of their paychecks and the crucial funding provided to these programs. It is also essential for individuals to stay informed about any changes or updates to FICA tax rates and regulations, as it can affect their financial planning for retirement. Overall, FICA tax is an essential aspect of the United States' social security system, providing vital support to millions of Americans every year.

Conclusion:

FICA tax is a fundamental component of federal employment taxation, crucial for funding key social security programs. Comprising Social Security and Medicare, it ensures income support and healthcare coverage for eligible recipients. FICA tax is calculated based on an individual's earnings and current tax rates, with employers matching their employees' contributions. While exemptions and special cases exist, most individuals are subject to FICA tax. Understanding FICA tax details helps individuals comprehend their paychecks and appreciate the vital role this tax plays in sustaining essential federal programs. Therefore, it is important for everyone to stay informed about any changes or updates to FICA tax regulations, as they can have significant impacts.

Best Dental Insurance for Braces of 2023

How to Calculate Property Taxes

Western Union: Everything You Need to Know for Smooth Transactions

A Comprehensive Guide for Capital Gains Tax Exclusion for Primary Residences

When to Expect Your Tax Refund

Explaining the Mechanics: Insights into Working and Premium Determinants

The Ultimate Guide to 529 Plan Withdrawals for Private Schooling

Why Your Home Is Stuck on the Market: Key Issues to Address

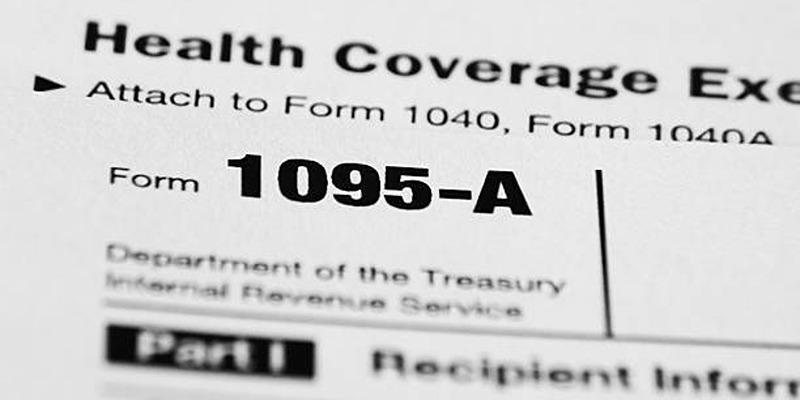

Understanding Form 1095-A: A Comprehensive Guide

Unveiling the Essentials of Comprehensive Car Insurance

Different Ways Home Buyers' Agents Earn Their Money